These checks were

directly tied to the credit card number and existing account. The functional implication

was that, if a customer changed his or her credit card number, the check would

bounce. This occurred when a customer’s credit card was replaced due to theft

or fraud, or if the customer switched to a different Citi credit card. Poor

customer experience!

Occasionally, the

business priority would be to solicit customers to upgrade their existing Citi

AAdvantage Card to a more premium product—say, from a basic card with a $50

annual fee to a Gold-level card with an $85 annual fee. The upgrade

solicitation list would be prepared in advance and deduped from the balance transfer check solicitation list. This not

only prevented checks from bouncing, it also allowed our customer

communications to focus on only one aspect of the credit card product during a

time period.

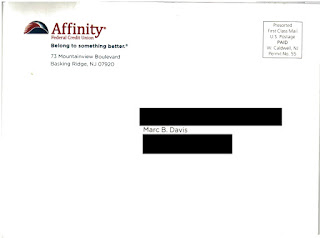

That policy from years

ago comes to mind when I reviewed these two offers, which the same person

received related to his Citi Thank You Preferred Card around the same time. In

late January, he received an offer to switch his existing Citi Thank You

Preferred Card to the new Citi Rewards+ Card. This new card offered a different points accrual

method. It’s a shiny self-mailer complete with details, comparison of the customer’s

current Citi Thank You Preferred Card to the new Citi Reward+ Card, and more

disclosures than you can shake a stick at. Creatively, this is a pretty persuasive

mailer.

|

| Outside of Upgrade Mailer |

A week later, in early

February, the same person received a self-mailer with an offer to add an

authorized user to his Citi Thank You Preferred Card. Specifically, the offer

was an opportunity to accrue 2,500 Thank You Rewards points—worth $25 in gift cards—if the customer adds an authorized user to the

card and spends $2,000 by 2/28/19.

|

| Outside of Citi Thank You Add A User Mailer |

The first Fail here is for a combination of Offer and Timing. Setting aside the upgrade offer, this offer has a response window of under 30 days. Normally, 30 days is an ideal response window to allow a customer enough time to read the mailer, consider the offer, and take action. But this offer requires the customer to take two separate actions. First, the customer has to request the card for the authorized user. Subsequently, the customer and/or the authorized user have to spend, together, at least $2,000. If there is an expectation that the authorized user would do the spending, the customer would have to wait for the card to arrive in the mail, activate it, give it to the authorized user, and hope that authorized user already had plans to make a pretty significant purchase or two. That’s a lot of activity to expect of a customer during the cold month of February.

|

|

| Inside of Citi Thank You Add A User Mailer |

Most credit card bonus

points offers for new customers have a window of 90 days to meet a spending

threshold. Perhaps Citi could have structured this offer such that the customer

would have 30 days to add an authorized user and another 60-90 days to meet the

spending requirement.

The second Fail is a

combination of Offer and Targeting. The fine print on the offer to add an

authorized user includes the line, “If your account is closed for any reason, including

if you convert to another card product, you may no longer be eligible for this

offer.” In other words, if the Citi customer accepted the offer he had received

one week prior to this one, then this offer is void. Poor customer experience!

When I worked at Citi,

we took measures to avoid overlapping offers. That does not appear to be the

case today. It does not appear to me that one of these mailers was delayed in

the mail for a long time, so let’s rule out bad postal delivery. Maybe the Citi

Rewards+ Card Product Manager wasn’t aware of what the Thank You Preferred Card

Product Manager had planned, or maybe they had conflicting business objectives. I can only

speculate.

Lessons:

- When planning the timing of your mailing and determining the offer response window, consider customer actions required to fulfill the offer.

- When you mail an offer to your own customers, be sure your offer doesn't conflict with other offers or create a negative customer experience.