As competition

in retail banking increases, brick-and-mortar

banks continue to offer incentives in the form of bonuses to

open an account. I recently wrote about TD Bank’s self-mailers.

This one from Santander Bank is

a simple postcard—in fact, it’s too simple. That’s why it merits a Fail for Creative.

|

| Postcard Front |

The front

of the postcard prominently messages the opportunity to get a $300 bonus for

moving to Santander Bank, but does not explain what that means. The only hint

of an explanation is a small message to “See reverse for important information.”

|

| Postcard Back |

The back of the postcard

communicates some of the benefits of banking with Santander and includes a Call

to Action to visit a website or visit a nearby branch with the postcard. That’s

nice, but what about that $300? What does a prospective customer need to do to

get the bonus? The explanation is buried in the long Disclosure. (If you

can read the explanation without visual support, you don’t need glasses.) While

the 17-line Disclosure is concise, it is not clear to a casual reader. That

lack of clarity is a Fail, because who wants to put on reading glasses just to

figure out what hoops to jump through to get the bonus?

I’m not a lawyer, so this isn’t legal advice. As a marketer, however, I think the lack of clarity may not only be bad marketing, it may also be a violation of FTC regulations. Current regulations state:

“When making ‘Free’ or similar offers all the

terms, conditions and obligations upon which receipt and retention of the ‘Free’

item are contingent should be set forth clearly and conspicuously at the outset

of the offer so as to leave no reasonable probability that the terms of the

offer might be misunderstood.”

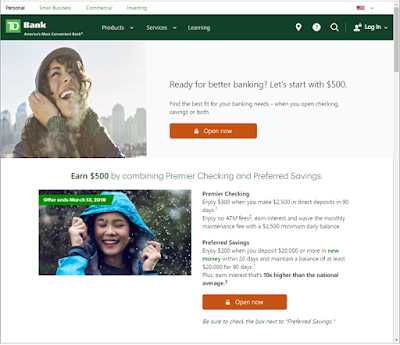

While the terms of the

offer to get the free $300 are clear, they are not conspicuous. The offer landing page explains the terms adequately; however, it

refers the customer back to the postcard. |

| Top of landing page |

Lesson:

When

presenting an offer to a prospective customer, clearly and conspicuously explain

what needs to be done to obtain that offer.