Since last July, the value of PayPal stock has fallen by about 75%. While many analysts are discussing the company's "fundamentals" and suggesting at what price to purchase the stock, I'm staying away for a different reason -- because they often produce Mail That Fails.

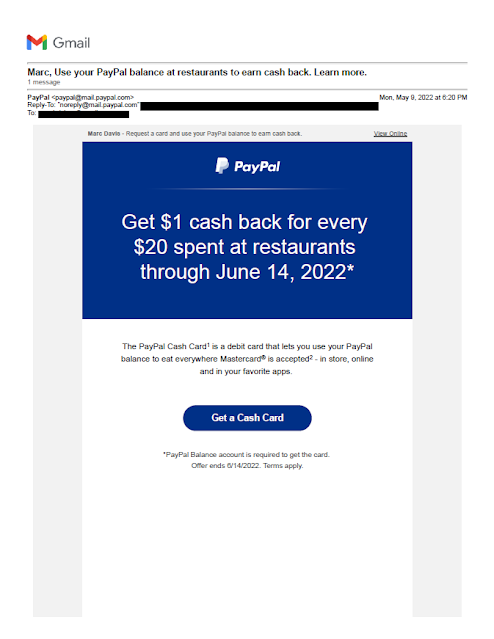

My first post about PayPal's several Fails was in 2011 when they mailed me a shoddy credit offer. There are a few more, including a recent one about a confusing and poorly targeted Venmo offer. Now, add to my list of PayPal Fails this offer of "$1 cash back for every $20 spent at restaurants."

Scanning the headline might make you think that going out to lunch four times -- spending $25 each time with your GooglePay app to use your PayPal balance for those lunches -- would earn you $5 cash back ($100 divided by $20 equals $5). But you'd be wrong…twice. The offer requires me to first request a PayPal Cash Card, then receive it in the mail and use it at a restaurant. All within 5 weeks of first receiving the offer – some of which is spent waiting for PayPal to process my request for the card. That's a lot of effort and a short window of opportunity for a small benefit, e.g. a Fail for Offer.

PayPal could have easily avoided this by using a rolling offer expiration date. For example, PayPal could require the customer to request the card by a specific date, but then give the customer a reasonable amount of time to use the card after activation, say, 60 days. That would be clear to explain and fair to the customer -- unless, of course, the intent is to make imply the offer is more generous then it actually is.

Which leads me to the actual offer value. I read through the disclosure text a few times, and I'm pretty sure that cash back offer is on a per-transaction basis. So, while each purchase of $25 would be worth $1 cash back and a $100 dinner might net $5 cash back, four lunches adding up to $100 would be worth only $4 cash back. If I'm right, this is a Fail for Offer and Content for being misleading. If I'm wrong, it is a Fail for Content for lack of clarity.

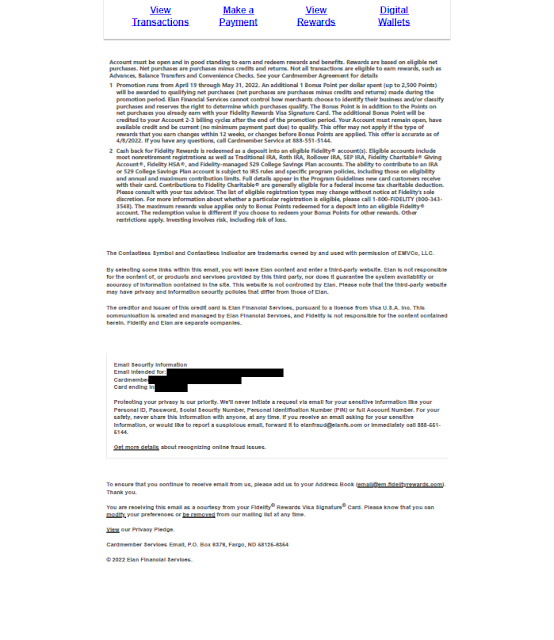

Another Fail for Content lies in the disclosures. It appears this disclosure was rushed and not proofread. Take this paragraph, for example:

"Eligible Purchase(s)": Eligible Purchase is defined as every $20.00 USD spent in-store or onlineusing the Card and finalized by the merchant during the Offer Period (defined below) in thefollowing category: restaurants (according to the Merchant Category Code (“MCC”) assigned byeach merchant, their processor, and the credit card networks. Only acceptable MCCs for this offerare 5812 and 5814). PayPal is not responsible for assignment of MCC codes. As a result, Reward willnot be awarded if the MCC code assigned to a particular merchant does not fall within a restaurantcategory, even if you believe that the merchant is a restaurant. Eligible Purchases do not include:(1) purchases that are marked as “pending” in your Card account as of the end of the Offer Period,(2) purchases made at eligible merchants using a third-party delivery service (3) ATM transactions,(4) gift card purchases, (5) any purchase or portion of a purchase that involves a payment methodother than the Card, or (6) in-store cash withdrawals/cash back.

Spaces are missing between words. The punctuation is inconsistent. Some numbers in parentheses have spaces before them; some do not. There’s also a missing comma after "service" in the last sentence.

There are references to "e-mail" in some paragraphs and "email" in other paragraphs. According to grammarly.com, both are correct as long as you use it consistently. PayPal is not being consistent.

These types of possibly misleading offers and unclear communications suggest to me that PayPal's leadership is spending their marketing dollars without full consideration of what they are doing and how they are doing it. As a stockholder, that would frighten me. As a customer, that also scares me a bit. If I can't expect to get a clean offer and clear communication, should I really be trusting PayPal to keep my personal information secure?

Lessons:

- Clearly communicate your offer.

- Allow your customers adequate time to respond to your offer and benefit from it's value.

- Proofread your entire communication, including your disclosures.

- Your customers' trust is potentially built or destroyed by every communication.

- The debate between "e-mail" and "email" isn't over, but at least pick a side.