Dunkin' recently overhauled their Dunkin' Rewards loyalty program. Some regular customers are not pleased. Coffee rewards that used to be available after spending $40 on coffee now require at least $50 in spend. The program has also become more complex, with a different points earning formula, monthly boosters and a greater emphasis on food. With greater complexity comes greater risk of error.

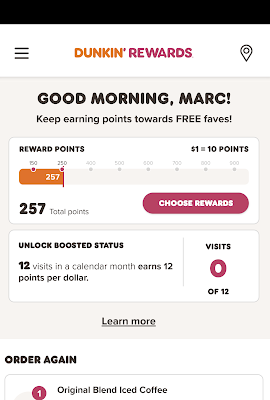

I would describe myself as an occasional coffee achiever. I might stop for coffee early in the morning when walking the dog, but not that often. I currently have 257 points according to my app -- not enough for one free coffee.

|

| Screenshot showing I have 257 points |

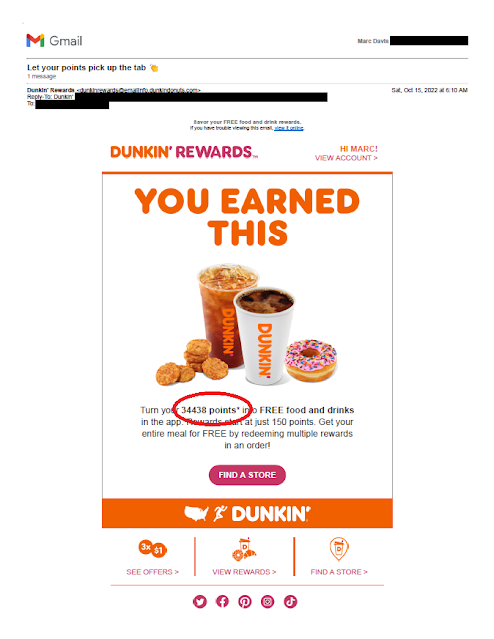

So, imagine my surprise when I received this email.

|

| Points amount email 34,438 points = almost 69 free coffees! |

The points value in the email is not only incorrect, it is outrageously wrong. Why would anyone hold on to 34,000 points?

In a prior role, I worked on a loyalty program mailing that included a mention of a customer's point balance. Here are some of the quality control steps I took:

- Verified output data against source data

- Verified lettershop proofs against both source data and output data

- Requested manual review of customers with points balance more than two standard deviations above the mean against source data.

Lesson:

When sending personalized information, verify the accuracy of all variable data including outliers.