A couple years ago, I wrote about a credit card solicitation I received from PenFed Credit Union. It took some serious sleuthing to understand why I would be eligible for membership. Since then, I've received a few others from PenFed, including this one for a PenFed Platinum Rewards Visa Signature Card.

I received this mailing as someone who isn't a PenFed member, isn't a member of the armed forces, and is someone who knows about PenFed only because of writing this blog. The letter includes a paragraph explaining that I need to become a member to get the credit card. So, it's probably safe to conclude that the mailer's target audience includes people who don't know much about PenFed.

Their recent solicitation is again pretty typical for a mid-tier credit card provider: window envelope; letter with Johnson Box; clear Call to Action; Schumer Box; brochure insert; and required credit prescreen opt-out notice. Let's break it down.

The window envelope is clearly branded. Unlike the one from two years ago, this one does not have a teaser.

|

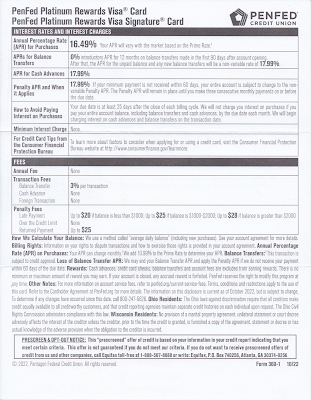

The personalized letter opens with a straightforward Johnson Box message: Earn 15,000 points when you spend $1,500 in the first 90 days. Nice. The letter opens by communicating a benefit that the rewards card works with my lifestyle. I can earn bonus points by doing what I do. I can get 5x points for filling my car's tank -- or even charging my EV, so forward-thinking! -- 3x points for food shopping or eating and doing other everyday stuff, and everyday 1x points for all those other purchases. The points accrual rates are reinforced in the right margin.

The letter closes with an explanation that I need to become a PenFed Credit Union member to get the credit card. It's a simple process, so all I need to do is scan the QR code or go to their website to get started.

The back of the letter reinforces points accrual and compares it to other credit card providers that offer points, then reinforces the Call to Action.

The points proposition is reinforced with a tri-fold brochure reinforcing points accrual rates. It also communicates some secondary perks such as Tap to Pay and Fraud Monitoring, but mainly it's about how all those points can really add up -- and the Call to Action is reinforced yet again.

|

| Brochure Cover |

|

| Brochure inset |

|

| Brochure inside |

|

| Brochure back |

|

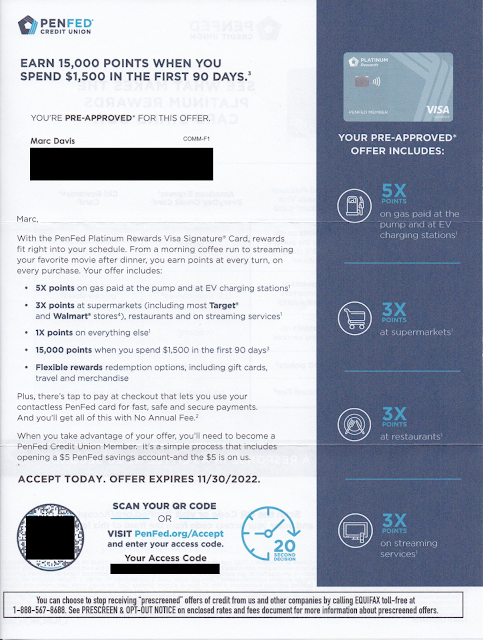

| Credit disclosures, including Schumer Box |

|

| Back of credit disclosures page (blank page) |

- Consider an enticement for the prospective customer to open the envelope. There should be an envelope teaser that would motivate the recipient to open the envelope. Given that the target audience is non-members (e.g. do not have a relationship with PenFed) this is more important than usual. (The "You're Pre-Approved" message in the standard size window is easily missed.)

- Since the audience includes non-members who don't know them, PenFed should introduce itself. Maybe PenFed has strong brand recognition within the military community; but, since I also received it, they are presumably also soliciting new customers who haven't served. Consider using the Who We Are content from the website and include it on the back of the required disclosures sheet, or squeeze a message in the letter or the brochure.

- Share the value of points. There is plenty of space allotted to points accrual, but nothing about how the points can be used. Explain if points can be used for travel, cash back, donations to the USO, or something I might enjoy. Also, the lack of quantification of value can be suspicious. Perhaps that 15,000-point intro bonus is worth less than the 10,000-point bonus with the compared-to American Express EveryDay Credit Card -- or perhaps it takes 20,000 points to get a shiny nickel.

Lessons:

- Think about your target audience. If they are not current customers, help them get to know you.

- When soliciting prospective customers, include a conspicuous teaser message to give them a reason to open your envelope.

- Communicate benefits. Points are not a benefit. They are a vehicle of earnings toward a benefit.

- Paper is expensive. Don't waste any. Leverage blank space to sell some more.

.png)