I left AT&T but remained a member of its credit union. A

few years later, the credit union expanded its membership criteria and rebranded

as Affinity Federal Credit Union (AFCU). I have watched

over the decades as the credit union’s marketing communications evolved from

simple and homely to complicated and flashy. Sometimes, their complex messaging

leads to ambiguity and confusion.

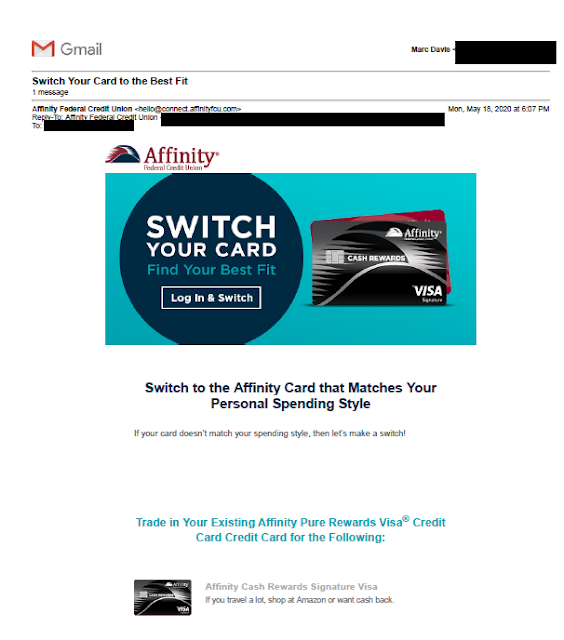

For example, I recently received this email selling a change

from my current Affinity Pure Rewards Visa Credit Card to an AffinityCash Rewards Visa Signature Credit Card. My current Visa card offers the

equivalent of 1% cash back on all purchases, plus up to an additional 5% on

purchases made through their online portal. The Signature Card earns – well,

based on the email – something that matches my personal spending style. Huh?

The Subject Line reads, “Switch Your Card to the Best Fit.” The

headline in the email reads “SWITCH YOUR CARD / Find Your Best Fit” – suggesting I

might be able to compare cards. The first Fail for Creative is the

contradiction between the Subject Line and email content. The Subject Line implies

that the Visa Signature Card would be my best fit; the Headline implies that I

need to find the card that is my fit; then, the Subhead suggests that the Visa

Signature card is meant for me. The card should either be good for me or not –

pick one.

It turns out that I have to find the card and work hard to

find the link to make the switch.

The email’s links to “Log In & Switch” do not lead to a

comparison page. They lead to the credit union’s general customer login page. From there, I have to log in; scroll past my account

balances, my pre-approved auto loan offers, a solicitation to consolidate

outside accounts, an offer to track all my purchases by category, and a review

of my rewards points balances and rewards available; and find a link in

12-point font reading, “Switch My Credit Card.”

This is a Fail because the offer requires substantial

customer effort to respond. Granted, the email explains part of this process,

but that only partially mitigates the friction present in the transaction. Furthermore, there is not an easy way for me to compare my current card to this new one. Which benefits are the same? Which ones are different? What benefit might the customer lose by making the switch?

If I haven’t given up and I manage to click on the “Switch

My Credit Card” link, this confirmation screen appears:

This confirmation screen is the first point in the customer experience that mentions specific product benefits. The product description reads:

Unlimited cash back with no annual fee. Earn up to 5%

cash back on all purchases, including bookstores like Amazon.com, access 24/7

Visa Signature Concierge, cell phone protection, travel benefits and more.

This sales message is another Fail for Creative. Overall, the sales message is fairly incoherent, with a confusing string of dependent clauses.

It is sparse and written poorly. Let’s break it down:

- “Earn up to 5% cash back on all purchases”: What does “up to” mean? Do I have to meet a purchase threshold to earn 5%? Does 5% apply only to purchases up to a threshold amount? Or is some other dynamic in play?

- “…including bookstores like Amazon.com”: Amazon is not a bookstore. It is a shopping site that sells just about everything you can have shipped to you, digital services, even house cleaning. Does this phrasing mean I would earn up to 5% cash back only on books? Or on anything purchased on Amazon.com? The Amazon app is not a dot-com. Are those purchases eligible? What are “bookstores like Amazon.com”? Does that include books on barnesandnoble.com? What about jigsaw puzzles on barnesandnoble.com? Does it include my local brick-and-mortarbookstore? What about books on target.com?

- “Cell phone protection”: What does that mean?

I was able to find more information on this product sales page. It appears to have some explanation of what “bookstores, including

Amazon.com” means. If I understand the footnote…

2 Cardholders will earn 5% cash back (which is equivalent to 5 points for every $1 spent) for purchases made at Bookstores, which also include purchases made at Amazon.com on up to $3,500 per month in purchases, excluding gift cards. Please note that these bonus categories are categorized by specific Merchant Category Codes. Not all merchants may use the specific qualified transactions codes. The additional points may not be issued, if the merchant does not use a qualified Merchant Category Code.…a customer earns 5% cash back at Amazon.com and at all bookstores. If so, why not state that outright? Or perhaps simplify the offering and make it applicable to only Amazon.com, as Discover Card does in its quarterly calendar?

The same page mentions the feature of cell phone protection

as an exclusive “card-holder” benefit:

Lessons:

- The content of a marketing email should complement the Subject Line.

- Marketing communications should explain at least some product features to support benefits messaging.

- Marketing emails should have a simple call to action.

- A customer's online sales journey should start with supporting the email sales message, then quickly and easily bring the customer through the sale.

- Amazon is not a bookstore.

- Proofread your content.

- If you message a product feature, make available a clearly communicated explanation of what it means.