If

we said it was all scams we could also be in trouble, but 'bulls---,' oddly, is safe. So forgive all the 'bulls--- language', but we're trying to talk about

the truth without spending the rest of our lives in court."

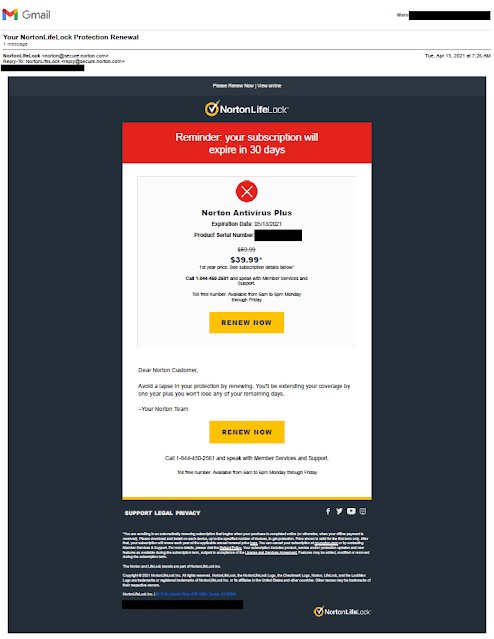

I'll enlarge the fine print to a readable font size:

You are enrolling in an automatically renewing subscription that begins when your purchase is completed online (or otherwise, when your offline payment is received). Please download and install on each device, up to the specified number of devices, to get protection. Price shown is valid for the first term only. After that, your subscription will renew each year at the applicable annual renewal price here. You can cancel your subscription at my.norton.com or by contacting Member Services & Support. For more details, please visit the Refund Policy. Your subscription includes product, service and/or protection updates and new features as available during the subscription term, subject to acceptance of the License and Services Agreement. Features may be added, modified or removed during the subscription term.

* The header of the pricing landing page reads: "Our renewal prices for standalone and add-on subscriptions are listed below. They may change, but we will always send you a notification email prior to billing." In other words, the actual second year price in 12 months could be substantially greater than the price shown today.