The first direct mail campaign I managed was an offer for The Practical Blue Hen, an informal guidebook I wrote for new students at the University of Delaware. At the time, I was a student there and partnered with a student organization to obtain a list incoming freshmen. I composed a solicitation letter, had a local printer print it, and offered pizza to anyone in the dorm who would help me stuff them in envelopes printed with the University of Delaware and Resident Student Association logos. I figured that every incoming freshman and their parent would open mail when their college is in the return address, and many of them would buy the guidebook.

I was right -- the mailing had a 40% response rate!

|

| WorryFree Example |

Someone at American Water Resources (AWR) also learned that lesson. They partnered with the New York City water board to sell water and sewer line protection services. That partnership allows them to use the NYC Department of Environmental Protection (NYC DEP) logo -- familiar familiar to New Yorkers. NYC DEP collects trash and recyclables, manages some of the local utilities, and bills homes for water use. Someone who gets a letter from the NYC DEP is going to at least pay attention to it.

Sometimes their mailers include logos from both AWR and NYC DEP, and sometimes only NYC DEP.

|

| AWR Examples |

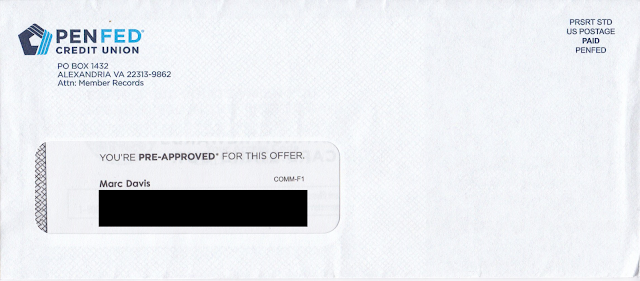

Recently, I recently received a solicitation from HomeServe that tries to copy the AWR approach but merits Fails for Targeting and Content. The return address leverages a logo from PSEG, a utility that most New Yorkers would not know. PSEG serves New Jersey, not New York. In some parts of Long Island and a small part of Queens, they operate under the name of PSEG Long Island. But PSEG by itself -- nah, in mainland Queens, we haven't heard of them. The cobranding effort is wasted.

In contrast, AWR mailers effectively leverage their partnership by giving a a bit of an official feeling to the envelopes. They include a call to action with a respond-by date, giving some urgency. They also include mention of an incentive right on the envelope. Smart -- who doesn't want a $50 credit? But WorryFree doesn't do that. Their lead-in is, "A message from PSEG," which seems pretty soft. No color, no message, no urgency. I'd love to run an A/B test comparing AWR's envelope style to WorryFree's, but if I couldn't, I'd go with AWR's. It motivates action.

Lessons:

- Cobranding can be highly effective when the cobrand is relevant to your target audience.

- Cobranding and compelling messages on an envelope can get past mailbox clutter and motivate action.

.png)

.png)

.png)