In a single day last week, I received five emails from FTD Flowers, each with a different subject line:

- Psst... Someone Special's Birthday is 5 Days Away

- Share The Love ❤️ An Important Anniversary Is In 7 Days!

- 🌹🌹🌹 3 More Days To Order Anniversary Flowers! 🌹🌹🌹

- Someone Special's Birthday is TOMORROW!

- Someone Special's Birthday is 7 Days Away!

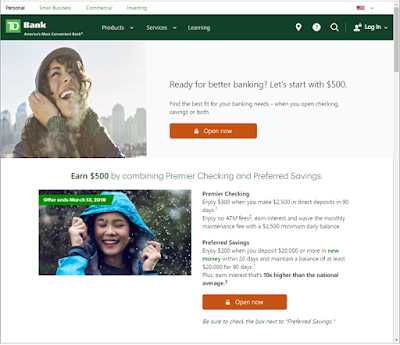

Here is an example of one of those five emails. |

| 1 of 5 emails I received on 12/9/20 |

That evening, when I read the first one, I was confused. Whose birthday was in 5 days? According to my Google calendar, the only person I could find with a birthday that day was a former business colleague. We were friends, but not close enough that I'd send him flowers. I checked my FTD purchase history and found nothing for this timeframe. Hmm, I thought -- maybe I need to dig up my old personal calendar I last used during the Clinton administration.

|

| Apology Email Sent 12/10/20 25% Discount Expired 12/11/20 |

FTD had quickly recognized its issue, admitted the error, and offered an explanation and an apology. This is a thoughtful approach, similar to what Amazon did several years ago when it sent out a BCS Championship winner merchandise email early.

*Offer expires at 11:59 p.m. CT on 12/11/2020 or while supplies last. Quantities may be limited. All discounts shown. Discounts are not applicable on: (i) product customizations including vases or product add-ons, (ii) FTD Membership fees, (iii) gift card purchases, (iv) service, delivery or shipping fees and applicable taxes, (v) special collections including Nambé, Baccarat or other special collections designed by FTD, and (vi) all "Gifts"under $24.99 or products under $19.99. Discounts cannot be combined. Offers may be subject to change without notice. See www.ftd.com for additional details.

The apology email merits Fails for both Offer and Creative. The Fail for Offer is because the discount window less than 38 hours after the apology email was sent. That's barely enough time for a customer to react to the email and make a purchase. The Fail for Creative is because a customer has to read the fine print to realize this, thus the apology appears to be disingenuous.

When an offer with a short response window does not message the offer expiration date in the body of the communication, the seller risks customer dissatisfaction -- the type that motivates a customer to shop elsewhere. Or, to put it bluntly, if you pee on a customer's leg and tell them it's raining, that customer will not buy an umbrella from you.

Lessons:

- If you make a mistake, own up to the error.

- When making amends for a mistake, offer a genuine goodwill gesture.

- If your offer expires quickly, you should communicate that fact in the body of a communication, not bury it in a disclosure.