|

| So many Celebrity Cruises emails, so little time to read them |

Lesson:

Direct marketing isn't only transactional. It's about building a relationship that improves the customer experience.

Examples of and lessons from communications that neglect basic direct marketing Best Practices.

|

| So many Celebrity Cruises emails, so little time to read them |

Lesson:

Direct marketing isn't only transactional. It's about building a relationship that improves the customer experience.

Dunkin' recently overhauled their Dunkin' Rewards loyalty program. Some regular customers are not pleased. Coffee rewards that used to be available after spending $40 on coffee now require at least $50 in spend. The program has also become more complex, with a different points earning formula, monthly boosters and a greater emphasis on food. With greater complexity comes greater risk of error.

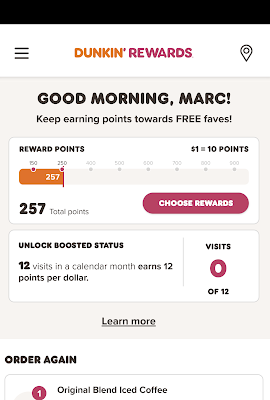

I would describe myself as an occasional coffee achiever. I might stop for coffee early in the morning when walking the dog, but not that often. I currently have 257 points according to my app -- not enough for one free coffee.

|

| Screenshot showing I have 257 points |

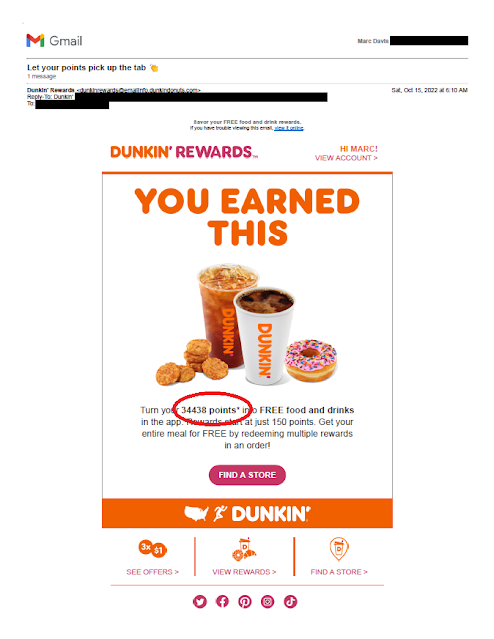

So, imagine my surprise when I received this email.

|

| Points amount email 34,438 points = almost 69 free coffees! |

The points value in the email is not only incorrect, it is outrageously wrong. Why would anyone hold on to 34,000 points?

In a prior role, I worked on a loyalty program mailing that included a mention of a customer's point balance. Here are some of the quality control steps I took:

Lesson:

When sending personalized information, verify the accuracy of all variable data including outliers.

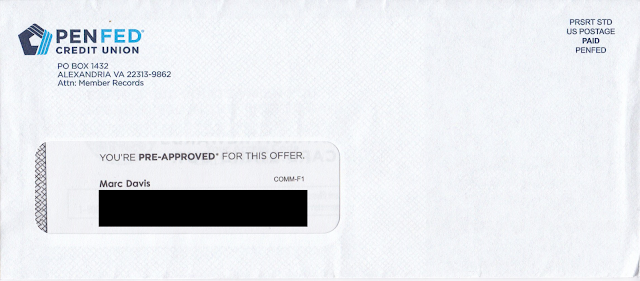

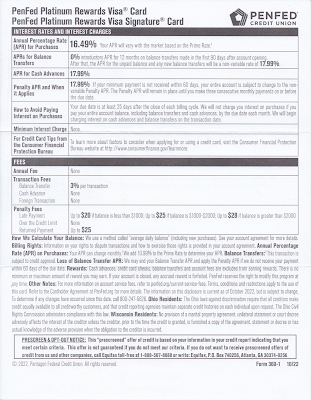

A couple years ago, I wrote about a credit card solicitation I received from PenFed Credit Union. It took some serious sleuthing to understand why I would be eligible for membership. Since then, I've received a few others from PenFed, including this one for a PenFed Platinum Rewards Visa Signature Card.

I received this mailing as someone who isn't a PenFed member, isn't a member of the armed forces, and is someone who knows about PenFed only because of writing this blog. The letter includes a paragraph explaining that I need to become a member to get the credit card. So, it's probably safe to conclude that the mailer's target audience is who don't know much about PenFed.

Their recent solicitation is again pretty typical for a mid-tier credit card provider: window envelope; letter with Johnson Box; clear Call to Action; Schumer Box; brochure insert; and required credit prescreen opt-out notice. Let's break it down.

The window envelope is clearly branded. Unlike the one from two years ago, this one does not have a teaser.

|

The personalized letter opens with a straightforward Johnson Box message: Earn 15,000 points when you spend $1,500 in the first 90 days. Nice. The letter opens by communicating a benefit that the rewards card works with my lifestyle. I can earn bonus points by doing what I do. I can get 5x points for filling my car's tank -- or even charging my EV, so forward-thinking! -- 3x points for food shopping or eating and doing other everyday stuff, and everyday 1x points for all those other purchases. The points accrual rates are reinforced in the right margin.

The letter closes with an explanation that I need to become a PenFed Credit Union member to get the credit card. It's a simple process, so all I need to do is scan the QR code or go to their website to get started.

The back of the letter reinforces points accrual and compares it to other credit card providers that offer points, then reinforces the Call to Action.

The points proposition is reinforced with a tri-fold brochure reinforcing points accrual rates. It also communicates some secondary perks such as Tap to Pay and Fraud Monitoring, but mainly it's about how all those points can really add up -- and the Call to Action is reinforced yet again.

|

| Brochure Cover |

|

| Brochure inset |

|

| Brochure inside |

|

| Brochure back |

|

| Credit disclosures, including Schumer Box |

|

| Back of credit disclosures page (blank page) |

Lessons:

After months of COVID lockdown and isolation, I was finally going to set foot outside of Queens. My wife and I arranged for a weekend getaway upstate at a bed-and-breakfast with plenty of ventilation, air filtration and outdoor seating. It was our anniversary and, pandemic or not, we wanted to make it special.

We brought masks, gloves, sanitizer, and more sanitizer. I packed a rag and Lysol disinfectant just to give our room a once-over when we arrived. We brought packaged food in case the nearby restaurants were too busy. After confirming all the details and driving north for a few hours, I realized had I forgotten my mother's advice: Always pack clean underwear. Sorry, Mom!

I discovered a Jockey outlet store near our B&B. It had reopened from COVID lockdown the day before our trip. So, on our anniversary, we stopped at the store for a couple pairs of jockeys. The store manager, also wearing a mask and plastic gloves, understood that I wasn't familiar with the brand and helped me pick out something comfortable in my size.

The manager apologized that not all price tags were up to date as the store was shorthanded and had just reopened. No worries, I said; just ring me up. She asked to put me on the email list with an offer of an instant discount on my in-store purchase. I agreed, providing my email address.

That was two years ago. I haven't purchased anything from Jockey since then. (The underwear is fine; I simply don't need any more.)

In May of this year, I received an email with a Subject Line of "Thank you for joining Jockey Rewards!"

|

| Jockey Rewards Introduction Email, May, 2022 |

The wording of that subject line makes it seem like I recently joined the Jockey Rewards program, which is not the case. Perhaps giving the manager my email address in that outlet store two years ago had enrolled me in an older version of the program and I had now been auto-enrolled in the current program. This supposition is based on the answer on the Jockey's reward program FAQ:

|

| First FAQ at jockey.com/rewards mentioning "new and improved rewards program" |

Welcome to the new Jockey Rewards!

We've improved Jockey Rewards!

Other than the confusing subject line, the email is nicely done: on brand, communicative, friendly and persuasive. Overall, the email doesn't deserve a Fail for Creative. Perhaps it merits a C+.

Lesson:

Your subject line should be relevant to your customer.

Since last July, the value of PayPal stock has fallen by about 75%. While many analysts are discussing the company's "fundamentals" and suggesting at what price to purchase the stock, I'm staying away for a different reason -- because they often produce Mail That Fails.

My first post about PayPal's several Fails was in 2011 when they mailed me a shoddy credit offer. There are a few more, including a recent one about a confusing and poorly targeted Venmo offer. Now, add to my list of PayPal Fails this offer of "$1 cash back for every $20 spent at restaurants."

Scanning the headline might make you think that going out to lunch four times -- spending $25 each time with your GooglePay app to use your PayPal balance for those lunches -- would earn you $5 cash back ($100 divided by $20 equals $5). But you'd be wrong…twice. The offer requires me to first request a PayPal Cash Card, then receive it in the mail and use it at a restaurant. All within 5 weeks of first receiving the offer – some of which is spent waiting for PayPal to process my request for the card. That's a lot of effort and a short window of opportunity for a small benefit, e.g. a Fail for Offer.

PayPal could have easily avoided this by using a rolling offer expiration date. For example, PayPal could require the customer to request the card by a specific date, but then give the customer a reasonable amount of time to use the card after activation, say, 60 days. That would be clear to explain and fair to the customer -- unless, of course, the intent is to make imply the offer is more generous then it actually is.

Which leads me to the actual offer value. I read through the disclosure text a few times, and I'm pretty sure that cash back offer is on a per-transaction basis. So, while each purchase of $25 would be worth $1 cash back and a $100 dinner might net $5 cash back, four lunches adding up to $100 would be worth only $4 cash back. If I'm right, this is a Fail for Offer and Content for being misleading. If I'm wrong, it is a Fail for Content for lack of clarity.

Another Fail for Content lies in the disclosures. It appears this disclosure was rushed and not proofread. Take this paragraph, for example:

"Eligible Purchase(s)": Eligible Purchase is defined as every $20.00 USD spent in-store or onlineusing the Card and finalized by the merchant during the Offer Period (defined below) in thefollowing category: restaurants (according to the Merchant Category Code (“MCC”) assigned byeach merchant, their processor, and the credit card networks. Only acceptable MCCs for this offerare 5812 and 5814). PayPal is not responsible for assignment of MCC codes. As a result, Reward willnot be awarded if the MCC code assigned to a particular merchant does not fall within a restaurantcategory, even if you believe that the merchant is a restaurant. Eligible Purchases do not include:(1) purchases that are marked as “pending” in your Card account as of the end of the Offer Period,(2) purchases made at eligible merchants using a third-party delivery service (3) ATM transactions,(4) gift card purchases, (5) any purchase or portion of a purchase that involves a payment methodother than the Card, or (6) in-store cash withdrawals/cash back.

Spaces are missing between words. The punctuation is inconsistent. Some numbers in parentheses have spaces before them; some do not. There’s also a missing comma after "service" in the last sentence.

There are references to "e-mail" in some paragraphs and "email" in other paragraphs. According to grammarly.com, both are correct as long as you use it consistently. PayPal is not being consistent.

These types of possibly misleading offers and unclear communications suggest to me that PayPal's leadership is spending their marketing dollars without full consideration of what they are doing and how they are doing it. As a stockholder, that would frighten me. As a customer, that also scares me a bit. If I can't expect to get a clean offer and clear communication, should I really be trusting PayPal to keep my personal information secure?

Lessons:

Remember the good ol' days when penny candy was only $5 a pound? Back then Entertainment Weekly actually published an issue every week.

Those good ol' days lasted until about three years ago. In August 2019, Entertainment Weekly went monthly -- lasting only until the April 2022 issue before ceasing print publication for good. Ah, well, I used to enjoy reading their "Must List" on the subway.

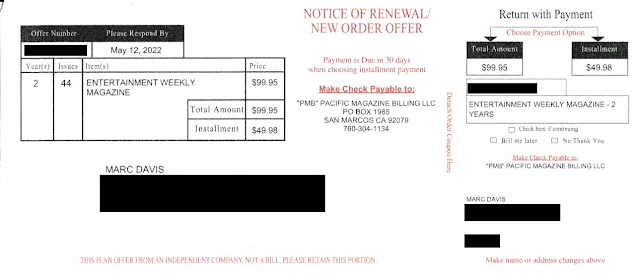

About six weeks after EW's last issue, I received this envelope package from Pacific Magazine Billing. (Normally, when I first mention a company, I include a hyperlink to the company's website; however, there is no website to be found.)

|

|

| Not-A-Bill for cancelled publication |

The "NOTICE OF RENEWAL / NEW ORDER OFFER" was for two years of Entertainment Weekly for the low, low price of only $99.95. The Terms and Conditions call out that this is "just an offer and not a bill ..." but it sure looks like a bill.

|

| Outer Envelope |

|

| Pretty Simple Reply Envelope |

A lot of sites declare Pacific Magazine Billing to be a scam such as here, here, here, here, here and -- well, you get the idea. Sometimes a scam is a scam but might still be legal. I don't know; I'm not a lawyer. I do know that a scam mail package is naturally a Fail for Creative. But this package isn't only an apparent scam; it is Fail for Timing. I mean, it is pushing for a subscription renewal for a defunct publication.

Alas, I "Must Not."

Lesson:

If you are going to scam, scam smartly.

|

|

| Mommy is happy with her healthy baby. |

|

| Where is Forest Hills, Queens? Not in the area shown on the postcard. |

|

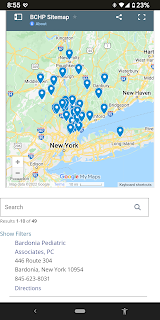

| BCHP locations not quite near Queens |

As the crow flies, the distance from Forest Hills, Queens, NY to Bardonia is about 27 miles. As the parent drives in traffic, however, it is two toll bridges and typically an hour drive or longer with a sick or tired child in the back seat. (That assumes the parent has a car. After all, this is New York City.) This long distance to a physician confirms that the postcard was poorly targeted geographically – another Fail for Targeting.

Returning to the caption below the map, what is a “pediatric provider?” Why use that kind of industry jargon when the front of the postcard uses “pediatrician” and “pediatric specialist” while the address side of the postcard cites having 55 “practices”? Why throw yet another term out there? I realize I’m not a parent but, if I were, wouldn’t I want to find a “doctor” for my child?

Lessons:

|

| Address panel, with offer URL |

|

| Inside panel |

This recent email from PayPal trying to cross-sell Venmo merits Fails for Creative and Targeting.

Enrollment offer email, sent to long-term

Venmo customer

The email offers

me a straight cash bribe (or, as we say in marketing, an incentive) to sign up

for Venmo. The Call to Action is to click on the “Claim Your $10” link that

will bring me to the below landing page.

Landing page

lacks explanation of Venmo product features or customer benefits

The landing page

reinforces the incentive and discloses information about fees -- and allows me

to sign up for Venmo and verify my phone number.

But what is

Venmo? Neither the email nor landing page include a product explanation.

Simply put: If someone hasn’t used Venmo -- which is, after all, the kind of

person the email is targeting -- they would have no idea what it is

or why they should provide their mobile number to get $10. Both the email and

landing page should include benefit statements or at least some brief sales

messages.

Now, in fact, I

know all about Venmo. I’ve been using it for a long time, long enough for

Venmo’s parent PayPal to know that I am an active customer. That is why I give this a Fail for Targeting. There is no value in sending a new customer acquisition

offer to a long-term active customer like myself. Communications like this can

make customers question the strength of a brand.

Speaking of

brand, why doesn’t PayPal put its name behind Venmo -- at least on this

marketing email? For customers who haven’t heard of or used Venmo (like the

ones targeted by the offer), including phrasing such as “backed by PayPal” or

“a PayPal service” would at least lend some credibility to the product.

This isn’t the

first time PayPal has offered me an incentive for something without

explanation. Last year, PayPal sent me an offer for Honey that lacked a product value proposition. Nor is this the first time that PayPal has demeaned its

brand with shoddy marketing communications. These communications can implicitly

send a message to customers that PayPal doesn’t have its act together, which

could lead to decreased trust and decreased use. Is this a company to trust with cryptocurrency purchases?

Sometimes

marketing managers are so obsessed with their products, they forget the basics. That’s why they need to take a step back, review lessons like

the below, and avoid sending Mail That Fails.

Lessons:

We live in Queens -- a borough of New York City. It is also it's own county. It is not like any other borough or any other place in the world.

So to suggest that we live in nearby Brooklyn is like someone suggesting San Francisco-based DoorDash is actually in Oakland -- sure, it's nearby, but it's a different world.

I ordered from DoorDash once, although I'm not sure when or why. Maybe it was to take advantage of a credit card offer, or perhaps it was that time last year when my wife and I really, really wanted a Carvel ice cream cake but didn't feel safe taking the subway there in the middle of a pandemic. Regardless, that one order was enough to be added to their email marketing list.

DoorDash knows where I live: firmly in a Queens zip code. So, the only reason to send me an offer email with a Subject line of "Hey, Brooklyn" is to want to get a Fail for Creative. Brooklyn is a nice borough, but to suggest that we live there is insulting to those of us who can walk to the World's Fair Site or the Louis Armstrong Museum -- or can brag they live in the same borough where Peter Parker grew up with his Aunt May.

But, to suggest I live in Brooklyn? Ouch! Not even a month of free pizza could get me to say, "Fuhgeddaboutit." I'm going to just leave this picture here.

Lesson:

If you want to appeal to your customers based on locality, make sure you get their location right.

This birthday email from Hooters merits a Fail for Timing and a Fail for Creative.

The email informs the recipient that he has "10 Free Wings (Birthday)" and that his offer will expire in "1 days."

|

| Hooters Birthday email arrived well after the birthday |

The recipient's birthday was in late August. He did not receive a communication about his free wings prior to his birthday or on his birthday. The first time he found out he had the opportunity to have free Hooters wings served to him (presumably by a "Hooters Girl") was on September 20 -- one day before the offer expired.

The opening of the email reads:

Just a friendly reminder that your 10 Free Wings (Birthday) is about to expire. Come in and redeem your offer before it expires in 1 days.

This brief paragraph would read better as:

Just a friendly reminder that your 10 Free Wings offer for your birthday is about to expire. Come in and redeem your offer before it expires tomorrow.

One might joke about the sentences being written by a Hooters Girl, but that would be insulting to smart women who take the job. Regardless, it appears to me that the sentence was written by a someone using rudimentary mail merge software. The first sentence identifies the type of free offer in parenthesis. The programming of the second sentence did not take into account that the number of days may be a singular number.

Let's hope the wings are better than the grammar.

Lessons: