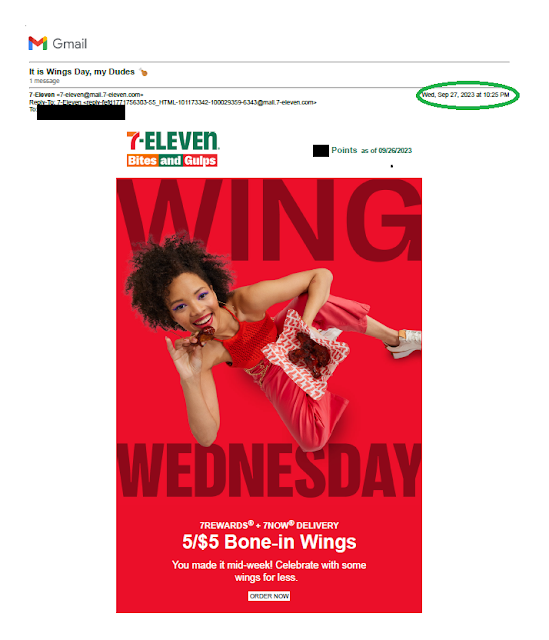

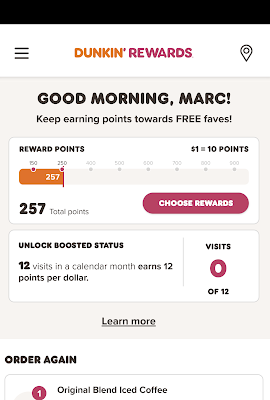

Last Wednesday, I received this email from 7-Eleven touting “Wing Wednesday” with an

offer for cheap wings. Is this Mail That Fails?

With a subject line of “It is Wings Day, my Dudes,” it seems

like there is a special price on wings that particular day. That impression is

bolstered by text saying, “Celebrate with some wings for less.”

|

|

| Wing Wednesday email |

Plus, the picture prominently displays, “WING WEDNESDAY” in

the background and body copy touting, “You made it mid-week!” These both suggest

that the 5/$5 Bone-in Wings is available only on, well, Wednesday.

But the email was sent to me at 10:25 pm on Wednesday, and

no matter how much I might love wings, that seems a bit late in the day to be prompted

for a mid-week wing order. So is this a Fail for

Timing?

Maybe not. Down in the Disclosures, we learn that the wings

offer is valid “thru” 1/9/24. So, it appears that I could enjoy these 5/$5

wings on a Thursday or on any other day over the next few months. Perhaps this

is a bit of a Fail for

Creative because it might mislead readers into thinking the offer is valid

only on Wednesday -- putting a damper on responsiveness.

Finally, is 7-Eleven using “thru” rather than

“through” to be informal and relatable? I don’t know.

Lessons:

- Align the timing of your emails to your message.

- Consider when and where it is appropriate to use informal language.

.png)